Welcome back to the second installment of the Sustainable Phage Therapy series by Ruby Lin!

In Part One: Phage manufacturing, regulations, health economics & reimbursement pathways, Ruby discusses the need for a sustainable ecosystem for phage therapy, which includes co-investment from the public and private sectors, robust manufacturing and distribution, and effective regulatory pathways. The blog also discusses the potential benefits of phage therapy, including cost savings and improved patient outcomes.

In Part Two, Ruby explores pathways to generating revenue through clinical services, biobanking, and companion diagnostics, and phage products.

5. A substantial target population

The patient population who would likely to benefit from phage therapy includes patients with severe infections from car accidents, burns, cardiac device, hip and knee replacement and breast implant surgeries, cystic fibrosis, and other non-hospital acquired infections.

Building on our experience and established science, clinical and industry network, the overarching vision is to establish a clinical network ready to apply phage therapeutics. Phage Australia aims to deliver an alternative to antibiotics treatment to curb the rising problems of AMR. Over the last few years and specifically last 12 months we have established a track record demonstrating that such a vision is both achievable and feasible in the immediate future.

To note, the AusPhageNet Clinical network have identified the following target populations (this is described in the MRFF Frontiers Stage 2 grant application):

| Target scenario |

Clinical Trials

in Stage 2 |

Notes |

| Devices and Implant Infections |

STAMP [1], diSArm [2], ACORN |

STAMP - TGA SAS scheme with clinical trial framework, uncontrolled, non-randomised salvage therapy (all AusPhageNet clinicians); disarm – Armata Pharmaceutical sponsored clinical trial. Staphylococcus aureus phage product candidate, AP-SA02Phase 1b/2a clinical trial; ACORN-HAI – a clinically oriented antimicrobial resistance surveillance network for healthcare-associated infections (David Paterson) |

| Resistant Gram-Negative Infections e.g., sepsis, UTI, cardiothoracic, any cohort that needs microbiological clearance endpoint |

STAMP, SNAP, PhAB, ACORN |

SNAP – randomised, adaptive platform to deal with Staphylococcus aureus sepsis (Steve Tong); STAMP – VRE (Vancomycin-Resistant Enterococci) (Morgyn Waner, Anton Peleg) |

| Cystic Fibrosis, Lung Related Infections |

STAMP, CF Kids, ACORN, PhAB |

CF Kids (Ameneh Khatami); |

| PhAB – CF Adults, nebuliser formulation (Stephen Stick) |

|

|

| Renal Dialysis patients |

STAMP |

STAMP – oral formulation |

| Difficult to treat infections in Indigenous and Asian Patients |

STAMP, PhAB, ACORN |

ACORN - Acinetobacter, Pseudomonas, Klebsiella, Melioidosis (Burkholderia pseudomallei, VRE. (all AusPhageNet clinicians) |

6. Broad potential revenue streams.

In the last 4 years I get asked this question a lot: can phage make money?

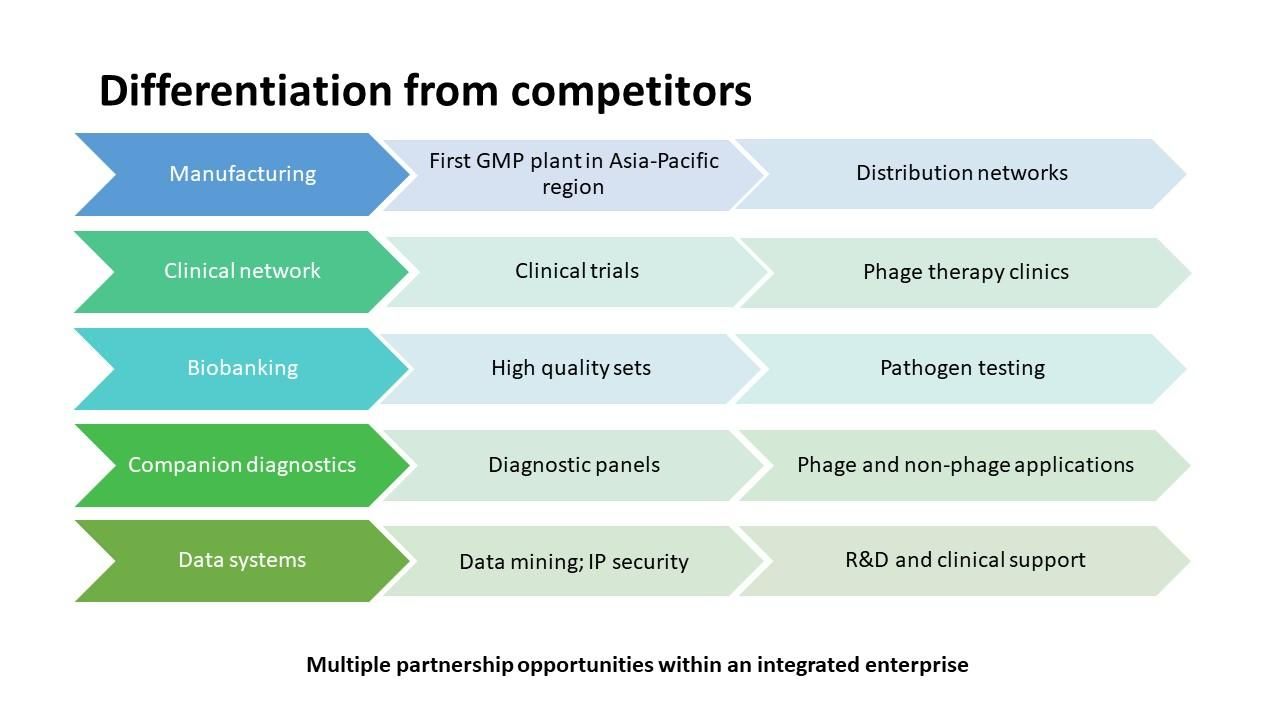

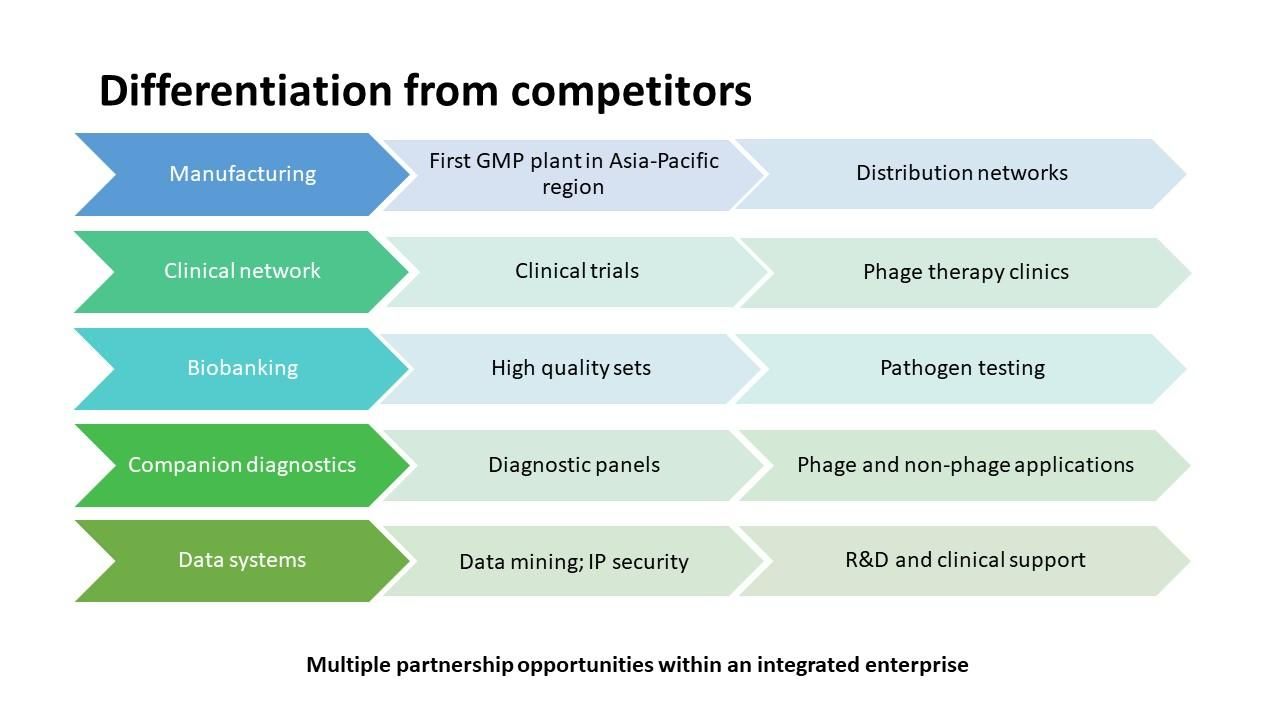

From my perspective, phage therapy will always have a public good element but having been managing studies involving phages as well as Phage Australia’s activities in the last few years, I can identify several components of Phage Australia, with potential to generate revenue, that differentiate us from competitors, these include:

- phage manufacturing/production,

- clinical services,

- biobanking,

- companion diagnostics and

- database/data management platform

Fig. 5. Overall components of Phage Australia that are attractive to potential investment. (credit: Laura Collie).

My prediction of income streams is as follows:

Income stream 1: Clinical Service

- Phage therapy sales for:

- Hospital purchases from their drug budget (government or private contracts)

- Private insurance (see Novartis strategy for CAR-T therapy [3])

- Reimbursement (regulatory policy needs to align)

- Philanthropy

- Clinical trials

- Companion diagnostics sales

- Fees for participation in education/training courses for Phage Therapy.

The target population outlined above gives investors an idea of the market for phage (in healthcare alone). I won’t discuss pricing and reimbursement models at this stage, but I anticipate rigorous discussions of “subscription of phages provided by a government health service” vs “direct billing of a phage product, fee for service” in the near future. Such legislation would impact how we (Australia) and other jurisdictions look at funding novel antimicrobials in health services (and broader applications, See One Health Initiative by WHO [4]).

Income Stream 2: COST-RECOVERY for BIOBANKING SERVICES

We have a collection of phages to screen against representative pathogens. Numerous high value phages can be put forward for therapeutic purposes.

A simple cost-recovery system is normal practice amongst well established biobanks e.g., DSMZ (https://www.dsmz.de German Collection of Microorganisms and Cell Cultures GmbH) and our local Core Facility WIMR biobank (>40 biospecimen collections). For example, WIMR biobank recoups costs by providing DNA and RNA extraction services for the biospecimens held by the facility, requested by researchers.

Beyond providing phages for clinical trials outlined here (and in the MRFF Frontiers Stage w proposal), this phage collection will be made available to those with any need for bioremediation or biocontrol. Use of phages is well established in the food and agriculture industry (PhageGuard, https://phageguard.com/ for listeria management), poultry, aquaculture and diary (Proteon Pharmaceuticals, https://www.proteonpharma.com/) etc.

To note, management and governance of this vast operation will require another discussion piece. Briefly, for Phage Australia, we have adopted a governance model with a national executive committee and an independent strategic advisory committee. In the first instance, terms of reference are signed off by Phage Australia partners, bound by mutual obligations and privileged access to data and biological materials (phages and reference strains). This will evolve in due course.

Income Stream 3: PACKAGED PHAGE and BACTERIAL PRODUCTS [5]

A large holding of phages from worldwide collections broadens the ability to screen and identify high value phages that can be put forward for therapeutic purposes. We have supported several cases in this way, i.e., 2 CF paediatric patients and 1 oncology paediatric patient requiring Mycobacterium abscessus phages and 1 paediatric patient requiring Pseudomonas phage [6]) and could do this as a service, with appropriate recompense to external owners under licensing agreements.

In this way, material transfer and licensing agreement should allow the Phage Exchange Program to present a curated collection of phages and bacteria ready for use. This includes;

- Phages of therapeutic value. Purified phage can potentially be provided with cost-recovery through the public health system (we have worked out patient journey and are costing this out). This income stream might ideally come from government and hospital contracts as a supplier of certified phages.

- Phages (single, cocktail, natural, genetically modified or chemically modified) targeting a specific antimicrobial resistant pathogen can be sold to external customers requiring such phages. Customers identified would include research laboratories and industry. Currently there is no service of this nature in the world. A major advantage is our access to a well-curated collection of pathogens (from surveillance programs) and phages. Metadata associated with the host bacteria and phages are systematically processed (SOPs are being established and in the process of harmonising across the network), curated, tested against relevant strains, sequenced and archived.

- The pathogen collections that enable this screening of phage are also of high value to research laboratories and pharmaceutical companies who wish to test their own new antimicrobial agents.

The emergence of COVID-19 in the last 3 years has highlighted global health threat from antimicrobial resistance but at the same time presents an opportunity for the antibiotic resistance market towards growth. The global antimicrobial resistance market was valued at $9.39 billion USD in 2020, and is estimated to reach $13.8 billion USD in 2027, with a compound annual growth rate of 4.68% from 2021-2027 [7]. WHO recognises that phage therapy offers an alternative approach to combat global AMR threat.

Income Stream 4: SYNTHETIC PRODUCTS

A survey of phage companies [8] indicated that genetic modification technologies (e.g., CRISPR) have been applied to phages, bacteria and plasmids to generate novel products that are protectable by patent, e.g., Locus Biosciences, BiomX and Eligo Biosciences. Chemically modified phages (e.g., conjugated with antibiotics (Hien Duong) or other valuable molecules and genetically modified phages (e.g., muddy from Graham Hatfull) will be truly novel and therefore protectable IP of potential high value.

Manufacturing Bacterial Host Strains.

While phage is the end product of a bioprocessing pipeline, the bacterial host strains are key to successful manufacturing. For example, Jon Iredell and Kamal Kamruzzaman have develop a process of curing harmful plasmids from a bacterium that can be applied even to strains with previously uncharacterised systems [9]. This approach can be applied to ensure that no harmful AMR plasmids are included in the production pipeline, even for phages whose main target is highly AMR strains that are normally full of such plasmids and might be otherwise difficult to produce. Any infectious diseases physicians and clinical microbiologist working at an Australian public hospital would appreciate such an approach.

A collection of such curated manufacturing bacterial host strains is potentially very valuable (specifically to satisfy regulatory requirement of a therapeutic phage production). Identifying key stakeholders in phage production, marketing and distribution are being mapped out. We believe that such a venture will be the first of its kind and will fill an unique niche in bioprocessing.

Income Stream 5: PERSONALISED PRODUCTS

Another attractive aspect of personalised production of phages is the Personalised therapy approach where target selectivity allows a spectrum of antibacterial activity to be tailored for clinical use. Thus, phage combinations or ‘cocktails’ can be designed to be broadly targeted to cover a range of important likely pathogens, or highly microbe-specific phage therapy can be used to leave intact the useful non-target microbiota (‘good’ bacteria) that would normally be damaged by antibiotics.

Personalised lifestyle product (not limited to clinical use) can also be developed. For example, there are phage companies dedicated to cosmetics (acne, https://phylabiotics.com/), animal/pet health (skin infection, gut microbiome) and poultry and dairy industry.

Management of gut health is part of the lifestyle supplements industry [10] that generates billions of dollars globally. Despite inherent poor regulation associated with this industry, I cannot help but speculate that phage products can be marketed as a preventative measure for many ailments. Scientifically, restorative effects of supplements that is relevant to gut microbiome and diet [11] can form part of the intervention strategies in, for example, sport science (e.g., enabling peak performance in elite athletes), cardiovascular diseases that involves the gut (e.g., hypertension), neurodegenerative diseases involving the gut (e.g., Parkinson’s) etc. Use of phages as a prophylaxis on medical devices and medical textile may also be a possibility.

Current trends in phage therapy involve commercial entities assembling phage cocktails to broaden the spectrum of activities of therapeutic formulations. This presents another set of challenges around the stability of combined phages, phage competition and the problem of routinely injecting high doses of mostly inactive viral particles (since often only one member of a ‘cocktail’ like this will be active against a given strain). An effective mechanism is to quickly screen an isolate against a large bank of phages or even to produce one quickly from bioprospecting. Phage Australia has demonstrated, specifically in the last 12 months that it is feasible to quickly screen (See up-and-coming work from Stephanie Lynch on Patient Screening Workflow) and focusing on bespoke therapy by quickly matching phage to patient isolate may have demand as an alternative service.

Agricultural and veterinary applications are also potentially important. A decade ago, there were only a handful of companies specialising in bacteriophage but by 2022, a fascination with the microbiome and the rise of antibiotic resistance means that bacteriophage research and development is enjoying a renaissance.

According to Credence Industry Market Research Report (October 2018), the global bacteriophage market held $567.9M USD in 2017 and is expected to grow at compound annual growth rate of 3.9% during the forecast period from 2018 to 2026. A list of phage companies on the market with their value proposition is curated by Phage Directory [8].

Part Three

In the third and last part of Ruby’s analysis, Ruby will discuss data-driven business models, and some concluding remarks. Stay tuned!

Feel like skipping ahead and reading the whole white paper? Read it on Phage Australia

Downloads

- AMR Sepsis PDF: Impact of Phage Therapy on AMR Sepsis, prepared by HTANALYSTS https://dl.phage.directory/WIMR01_AMRSepsis_WP_FINAL_26July2022.pdf

- PJI PDF: Impact of Phage Therapy on Joint Infections, prepared by HTANALYSTS https://dl.phage.directory/WIMR01_PJI_WP_FINAL_26July2022.pdf

References

-

Safety and tolerability of a standardised treatment and monitoring protocol for adult and paediatric patients receiving bacteriophage therapy (STAMP) protocol is approved nationally (2021/ETH11861, 22nd December 2021), and is registered at ANZCTR, CTRN12622000181707

-

https://www.prnewswire.com/news-releases/armata-pharmaceuticals-announces-first-patient-dosed-in-phase-1b2a-disarm-study-of-ap-sa02-in-adults-with-bacteremia-due-to-staphylococcus-aureus-301552450.html

-

https://www.novartis.com/research-development/technology-platforms/cell-therapy/car-t-cell-therapy-and-beyond

-

https://www.who.int/news-room/questions-and-answers/item/one-health

-

ATCC (https://www.atcc.org/) and Addgene (https://www.addgene.org) both package bacteria and phage products.

-

Khatami A, Lin RCY, Petrovic-Fabijan A, Alkalay-Oren S, Almuzam S, Britton PN, Brownstein MJ, Dao Q, Fackler J, Hazan R, Horne B, Nir-Paz R, Iredell JR. Bacterial lysis, autophagy and innate immune responses during adjunctive phage therapy in a child. EMBO Mol Med. 2021 Sep 7;13(9):e13936. doi: 10.15252/emmm.202113936.

-

https://finance.yahoo.com/news/global-13-8-billion-antimicrobial-110900720.html

-

Phage Directory: Airtable list https://airtable.com/shr8f1wbrK2hvR1an/tblCpqDQJjqyqgtj0/viw01yqq3wEoCCgie

-

Kamruzzaman M, Mathers AJ, Iredell JR. A Novel Plasmid Entry Exclusion System in pKPC_UVA01, a Promiscuous Conjugative Plasmid Carrying the blaKPC Carbapenemase Gene. Antimicrob Agents Chemother. 2022 Mar 15;66(3):e0232221. doi: 10.1128/aac.02322-21. Epub 2022 Jan 10. PMID: 35007138; PMCID: PMC8923210.

-

https://www.gowellnessco.com/gut-health-supplements/

-

Leigh SJ, Morris MJ. Diet, inflammation and the gut microbiome: Mechanisms for obesity-associated cognitive impairment. Biochim Biophys Acta Mol Basis Dis. 2020 Jun 1;1866(6):165767. doi: 10.1016/j.bbadis.2020.165767.